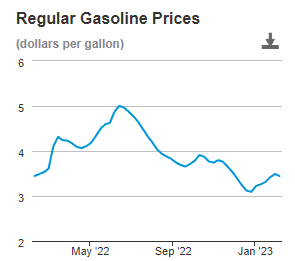

Gasoline price has been on the rise again lately and last year we paid up to USD5 per gallon in the US. That’s absolutely crazy and no wonder companies like Exxon has generated US55 billion of profits in its latest earnings announcement! Yet, we contribute everyday pumping up enormous profits to the company and its shareholders 😤

The stock price has jumped again yesterday +$3.19 and it seems that it will again reach the top of the uptrend channel around $117.5. Risk on downside may be at $102 support level. With oil still in demand more so on higher side for China and no change by OPEC at the recent meeting, we see that these oil companies may still continue the uptrend.

Time to get monthly subsidies?

Okay, if you are as fed up as me on high oil prices, lets get some subsidies from structuring trades around these oil companies, in particular XOM.

As the price is still on uptrend, doing a pure call, although have its benefits, we would not want to fall into a decay trap in volatile market conditions. If we are unlucky, sudden changes in price can evaporate earlier gains especially towards the expiry of the calls.

To avoid this, we structure something more unique with higher probability of profit, almost 90%… with no risk to the upside.

As I spend around USD100 petrol a month, I would want to get this back in full or at least 50% subsidized. It’s a rinse and repeat trade and you can recycle as many times as long as the price action is not on downtrend.

Trade Structure…

Strategy is to use Jade Lizzard, those “Tastynation” people would be familiar with this strategy which is:-

Sell a Bear Call Spread $1 width to get a credit of $0.30 [Max Profit $30 & Max Loss $70]

Sell a naked put to get a credit of $0.70 at least [max Profit $70 and max loss put strike price - premium received]

Duration 30 days [go to weeklies to get the $1 strike widths]

Why structure this way?

The naked put will cover for the max loss of Bear Call Spread in case prices breaches the strike prices of the Bear Call Spread.

If prices ends up on expiry in between the short put strike and short call strike price, we get the max profit.

Exit is possible when 50% of the premium is received. Just watch for the price when it goes towards the call strikes as that is where the profits will start to deplete…If you got profits half the way to expiry and we are close to breach the short call strike, it’s a good time to exit with some profits… 😂

Have a hang and feel of the P/L and after a few rounds using this strategy, you should get used to it.

What if it goes the other way, down??? 😭

Anything can happen and we need to prepare you for it. You got to understand that you are entering into a naked put position. Best is if you are fully cash secured as a newbie. Seasoned or more experienced traders, know how to manage your naked positions please. The bear call spread would have got 100% max gains expiring OTM, but because of the small width, there is no help rolling down the spread strikes. Manage the short naked puts by rolling in time if the put strike get breached. You can reenter another new bear call spread together with the rolling if you want.

Of course the worse is always possible that you get assigned the stock above market price…. 😝

When to execute?

As the price has just shot up, enter when there is a retracement, possibly back to the trend line of the chart above, it it goes below, even better.

Remember, it is important for you to get the premium ratio right. $30 for Bear Call Spread and $70 for naked put so you have no upside risk. If you do higher than $70 for the naked put, say $75, if price breaches above the Bear call Spread strikes on expiry you get to earn $5 for a gallon of petrol. You can also do $2 strike width but that will result in a higher delta for the naked put reducing the trade probability of profit.

Example on Trade Platform

Watch Traders Talk…

We covered the this strategy on Traders Talk last Tuesday 7 Feb 23. Watch the replay here (37.00)

Subscribe to our weekly options trading newsletter.

DISCLAIMER

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options: https://www.theocc.com/components/docs/riskstoc.pdf

MYstyework is an Online Financial Literacy Educator and materials provided is solely by MYstylework and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. MYstylework, through its contents, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. MYstylework is not in the business of transacting securities trades or an investment adviser.

Trade closed with 92% profit. 😉

Trade is nearing 50% profit...those who want to take and run go ahead...FREE Petrol 🤭